Starting something new is always intimidating, but you did it.

You put in early mornings, late nights, weekends, and maybe even got on a plane. You invested in yourself—and guess what? Most never do.

But now, you’re standing at the cliff edge. The real question is: Do you stop climbing or do you build something that lasts?

Because let me tell you—momentum dies in isolation. The skills you learned? They’re just the beginning.

And here’s the truth: mastery takes time. Reps. Community. Coaching. Execution.

That’s where Tax Resolution Practice Builders (TRPB) comes in.

This program was built for people who aren’t just “interested” in tax resolution—they’re committed to becoming elite.

What You’re Really Getting:

This isn’t just about more information – it’ s about transformation. You’re not buying content. You’re buying access, support, and velocity.

We engineered TRPB to do three things:

-

Sharpen your skills to elite level

-

Build a real, functioning tax resolution business

-

Surround you with people who push you, not pacify you

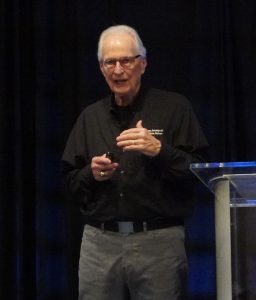

Larry Lawler, CPA, EA, CTRS

Larry Lawler, CPA, EA, CTRS Mitchell Piper

Mitchell Piper