Presented by the American Society of Tax Problem Solvers.

Advanced Webinar Series

Get ready to master:

IRS Levy and Sale Provisions

Thursday, Dec 28th | 1pm-3pm Eastern

Embark on a game-changing journey into the heart of the IRS’s most formidable tools – levies and sales. This isn’t just any course; it’s a power-packed, 2-hour intensive led by none other than Larry Lawler, CPA, EA, CTRS a titan in the tax resolution industry with 50 years of experience. Master the art of navigating the complex maze of IRS’s authority. You’ll emerge not just informed, but empowered, ready to tackle the most intricate tax resolution cases with confidence and finesse.

Why This Course is a Must for Your Professional Arsenal:

- Deep Dive into Bank and Wage Levies: Uncover the secrets behind the IRS’s grip on wages and bank accounts. Get the insider scoop on how to challenge these levies like a pro.

- Mastering Asset Seizure and Sale: Journey into the heart of IRS’s power to seize and liquidate assets. Learn to shield your clients’ rights with cutting-edge defense strategies.

- Jeopardy Levies Decoded: Tackle the urgency of jeopardy levies with skill and precision. Understand the nuances that can make or break a case.

- Navigating Alter Egos and Nominee Levies: Demystify the complexities of levies on alter egos and nominees. Arm yourself with legal theories that can turn the tide in your favor.

- Securing Taxpayer Rights: Delve into the IRS’s procedures for property possession. Learn to effectively challenge and protect taxpayer interests.

- Tangible vs. Intangible Levies: Become an expert in differentiating levy tactics on various assets. Your clients will thank you for this nuanced understanding.

- After-Acquired Property Insights: Stay ahead of the curve by understanding how the IRS targets newly acquired assets.

- Summons Power Unleashed: Decode the IRS’s summoning powers and use this knowledge to your client’s advantage.

- SMLLC Employment Tax Levies: Specialize in the unique challenges of Single-Member LLCs. This knowledge is gold in today’s market.

- Identifying Levy-Proof Property: Learn to identify and safeguard assets immune to IRS levies. This is knowledge that pays dividends.

- Advanced Topics & Legal Updates: Stay at the forefront of your field with the latest developments and complex scenarios.

Participants will earn: 2 CPE/CE credit

Field of Study: Taxation

Webinar Platform: Zoom

Handout Material: Delivered Virtually

Event Recording: Yes, 12 Month Access

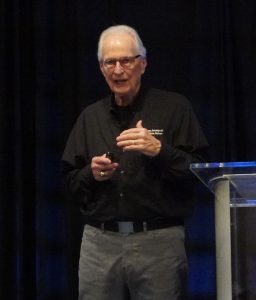

Presented by: Larry Lawler, CPA, EA, CTRS

Presented by: Larry Lawler, CPA, EA, CTRS

Larry is the Founder & National Director of ASTPS and the architect of the Accelerator Program. He has worked and consulted on literally thousands of IRS representation cases and is a frequent public speaker, a writer on professional topics, and a regular trainer of tax professionals nationwide. He has been a New York CPA since 1973. He is also a fellow of the National Tax Practice Institute. Larry is the managing partner of Lawler & Witkowski, CPAs, PC, the firm he established in 1973.

2 Hours of Tax Resolution Training

More knowledge = More Profit

It’s simple – The more you know and understand about tax resolution, the quicker and more efficiently you can work cases. This should result in more profit per case!

Confidently Represent

What was once difficult eventually becomes routine. As you gain confidence in your tax resolution abilities you can command higher fees and increase your capacity to take on work. More clients means more revenue.

Learn from Experts

If you’ve decided to commit a major part of your career to tax resolution you don’t have to reinvent the wheel. By ordering a program like this one you are going to learn best practices from seasoned professionals.

Member Discounts Apply

Membership discounts apply to this program. 15% for Premium members and 5% for Standard members.