December Accelerator

The ASTPS Accelerator is a hands-on, immersive, program that teaches you the fundamentals of IRS representation. Over the course of 4 days you will go through 27 hours of tax resolution training with a group of like-minded professionals.

Accelerator Registration

Membership Discounts apply to the member and their staff/w2 employees only. Registration under the wrong membership type will result in the registration being refunded and you will lose your spot and need to reregister.

Need help registering? Call (716) 630-1650 or email help@astps.org

- 27 hours of tax resolution training

- Samples, Forms, and Templates

- Approved by the IRS & NASBA

- 6 Hands on field training exercises

- Unlimited Q&A

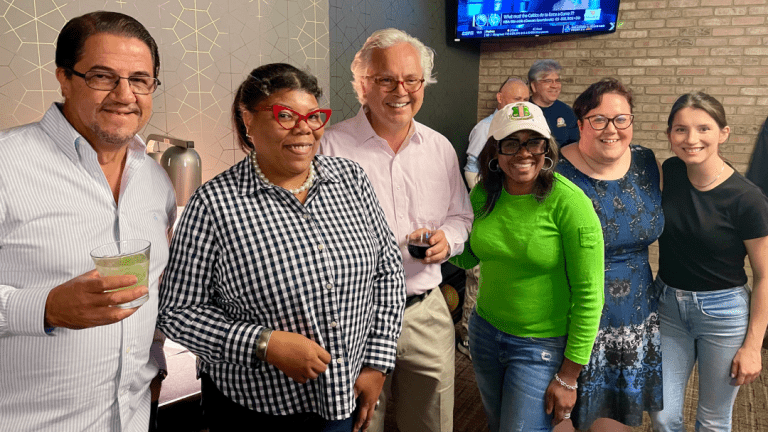

- Network with like-minded tax pros

- 3 month access to recordings

- 100% Money Back Guarantee

Previous Boot Camp Attendee?

Both previous Accelerator & Boot Camp attendees will be able to attend at 50% off the regular price of the event which is now $748.50.

Registering 3 or more people?

If your firm is looking to get 3 or more staff members trained there are additional discounts available. Please contact ASTPS at (716) 630-1650 for registration.

Are you an ASTPS member registering a staff member?

Membership Discounts apply to the member and their staff/w2 employees only. Registration under the wrong membership type will result in the registration being refunded and you will lose your spot and need to reregister.

Join us in Dallas!

Just a short journey from the vibrant heart of Texas, your extraordinary journey unfolds at the ASTPS Accelerator. In this serene oasis, where elegance meets the emerald fairways, discover the connections, celebrations, and indulgences essential for transforming ordinary moments into unforgettable experiences with unmatched grace and sophistication.

Dallas/Fort Worth Marriott Hotel & Golf Club at Champions Circle ($155/Night)

4.0 Stars on Tripadvisor | 4.3 Stars on Google

Hotel Address: 3300 Championship Pkwy, Fort Worth, TX 76177

Airport: DFW (30 min) | Love Field (40 min)

Top Attractions:

The Golf Club at Champions Circle

Outdoor Pool

Schedule

Below you will find the full schedule for the December Accelerator. You must attend “in real time” to receive continuing education credit.

Kickoff Session | Virtual

Dec 5th | 11:00am – 6:00pm Eastern

Main Event | Virtual

Dec 10th | 9:00am – 5:00pm Eastern

Dec 11th | 9:00am – 6:00pm Eastern

Dec 12th | 9:00am – 4:00pm Eastern

FAQs

What's included

Prior to the start of the event you will receive a package in the mail that will contain all of your course materials. You will also receive a link to download additional handouts and templates.

What technology is required

You should have a computer that is ideally connected to the internet by Ethernet connection, or a wifi connection that you trust. If you want to participate in Q&A sessions you should have a microphone and webcam.

Please note: Most questions submitted during the course by virtual attendees will be typed. The video and microphone would be for the special Q&A sessions.

What do I need to know about Zoom

Over the last two years of running virtual and hybrid events Zoom has been quite reliable. The events will be run on the Zoom Webinar platform and not Zoom Meetings. During the sessions no one will be able to see or hear you. During the special Q&A sessions you will be free to turn on your camera and microphone to ask questions.

Make sure your Zoom is updated to the latest version. Learn more here.

Returning Attendee Policy

Both previous Accelerator & Boot Camp attendees will be able to attend at 50% off the regular price of the event which is now $748.50.

Need to register multiple attendees?

If your firm is looking to get 3 or more staff members trained there are additional discounts available. Please contact ASTPS at (716) 630-1650 for registration.

Cancelation Policy

Cancel your Accelerator registration:

- 30 days or more prior to the event for a full refund.

- 29 – 14 days prior for a 50% refund & 50% credit

- 13 days or less there are no refunds but you can receive a full credit

100% Money Back Guarantee

We are so confident that you will be 100% satisfied with our program that we are willing to give you a FULL REFUND if you are not! If after attending stage 1, you do not feel like this program is right for you, simply return your materials and we will refund your registration fee.

“I’ve been in professional services for almost 30 years. I have taken dozens of training programs over the years. This was truly one of the best training programs I’ve ever attended. The materials, the facilitators, the topics, and the delivery were so far and above what I expected, I was truly surprised. Thank you for doing such an excellent job.” – James D.

“Really amazing! Folks, just no words to describe my satisfaction on investing in my practice to get it to the next level. I am new EA in 2021, but more than 30 years as Accountant, Comptroller & Tax Professional Preparer. I decided to become a member a year ago. In this field we can never stop learning. I need to take this one more time, but for now on ASTPS has equipped me to be more confident. Thanks for greats instructors. Mr. Larry, L.G., Steve, Angeline, Mitchell Etc. see ya again soon!” – Jorge P.

“Each of the 4 instructors was knowledgeable, informative & engaging. Their expertise & skills were readily apparent in the content they taught. I found LG & Steven equally interesting and funny with their quips and stories. Larry was more matter of fact, and in addition to all of the great info he imparted, had great recounts of situations in his many years in practice. Billy was great part of the team since he was formerly in the IRS and could impart knowledge & useful techniques from his years on the “inside”. I was fortunate to attend the on-sight instruction for 3 days & the time flew by quickly! The further experience to collaborate with the instructors and practitioner were golden moments filled with bits of additional knowledge & tools to use in this practice. I highly recommend this course for anyone considering IRS tax resolution. You owe it to yourself to spend the time getting more educated and gaining confidence to assist your clients with expertise!” – Katherine L.

“This was awesome! I had my entire staff attend and they are over the over the moon (pun intended!). You guys are great, and I love that I found you guys’ last year when I did. Wish I knew about you earlier.” – Randy H.